Publicaciones - Serie Banca Central Volumen 10 - Portal Biblioteca

PUBLICATION SHEET

Series on Central Banking 10: External Vulnerability and Preventive Policies

Series on Central Banking 10: External Vulnerability and Preventive Policies

Emerging market economies endure significant macroeconomic volatility. The large correlation between external factors, e.g., terms of trade and world interest rate shocks, and domestic macroeconomic volatility is highly suggestive of their key role, but it does not explain the mechanism through which they operate. The evidence hints at the presence of strong multiplier effects, of which financial mechanisms are leading candidates. Although a significant component of this macroeconomic volatility is exogenous to emerging markets, it does not mean that domestic policy is secondary. Quite the opposite: facing large volatility makes good domestic policy decisions all the more important. This volume is an attempt to characterize the main external shocks affecting emerging market economies, the sources of structural weaknesses, and the best policy frameworks for dealing with these problems. The main policy lessons are derived from a balanced combination of actual experiences documented through case and cross-country studies, and from normative analyses.

Language: English

Edited by: Ricardo J. Caballero, César Calderón y Luis Felipe Céspedes

Published: June 2007

$15.000

Available for free in digital format in the Digital Repository and Institutional Website

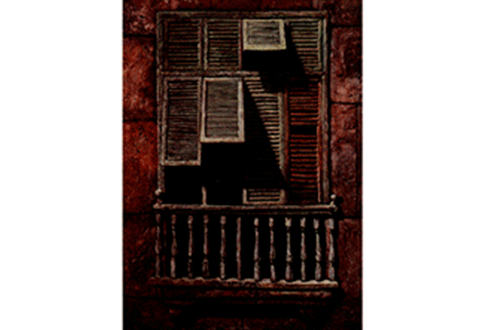

Work belonging to the Collection of Paintings of the Central Bank of Chile: "Misterio de la Ventana" by Ernesto Barreda (Oil on canvas, 100,5 x 145,5 cm.)